how to declare income tax malaysia

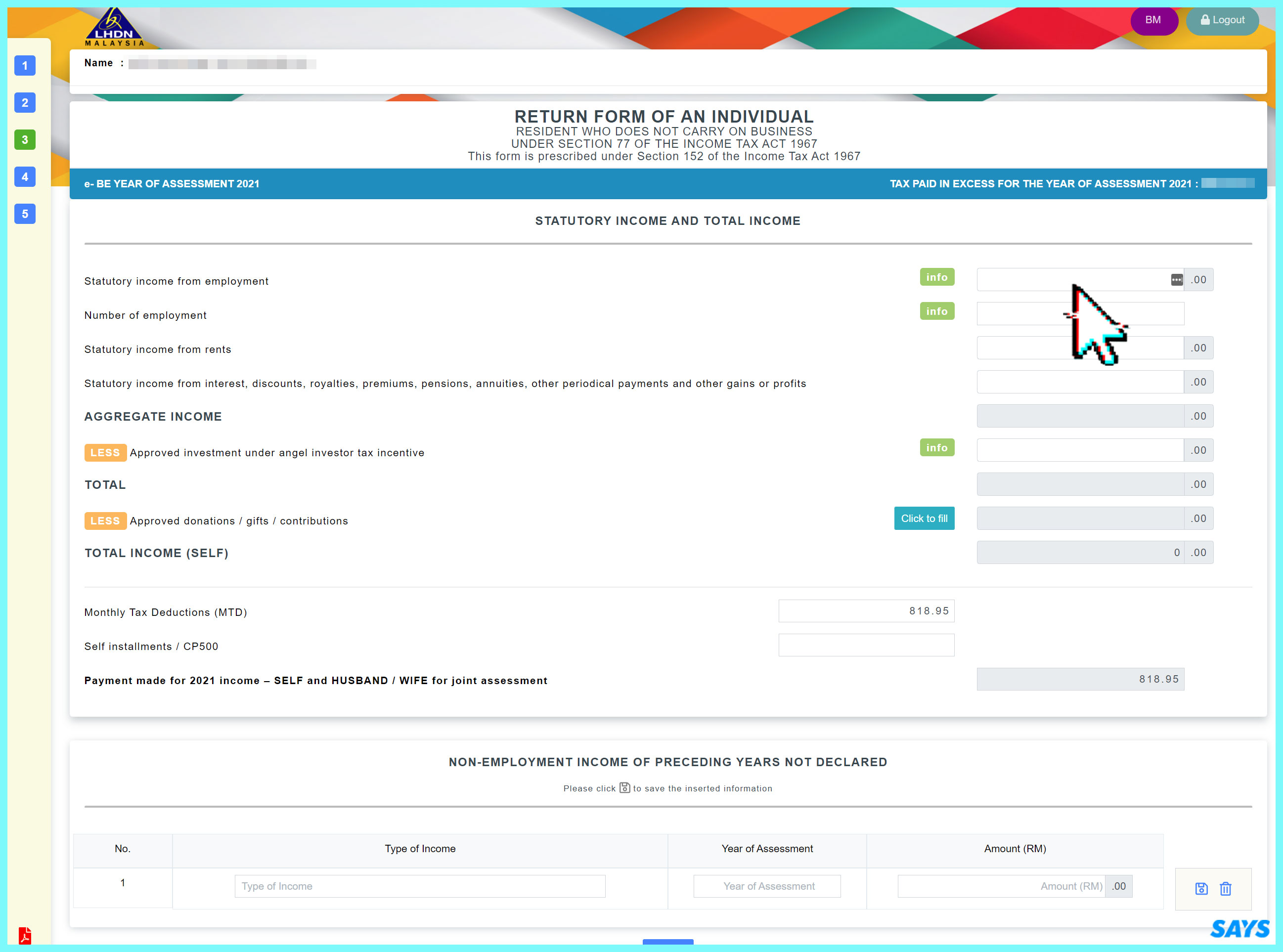

If youre not sure what counts as income that you have to declare for tax purposes or not scroll down to our section on stating your income below. If you have never filed your taxes before on e-Filing income tax Malaysia 2022.

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

This is explained in greater detail under Section 4d of the same Act.

. WTOP delivers the latest news traffic and weather information to the Washington DC. There are no local taxes on individual income in Colombia. Arts and Culture Malaysia and entrance fees to tourists attractions incurred on or after 1st March 2020.

American Family News formerly One News Now offers news on current events from an evangelical Christian perspective. Average Lending Rate Bank Negara Malaysia Schedule Section 140B. Fill in the form with your income information according to the relevant categories.

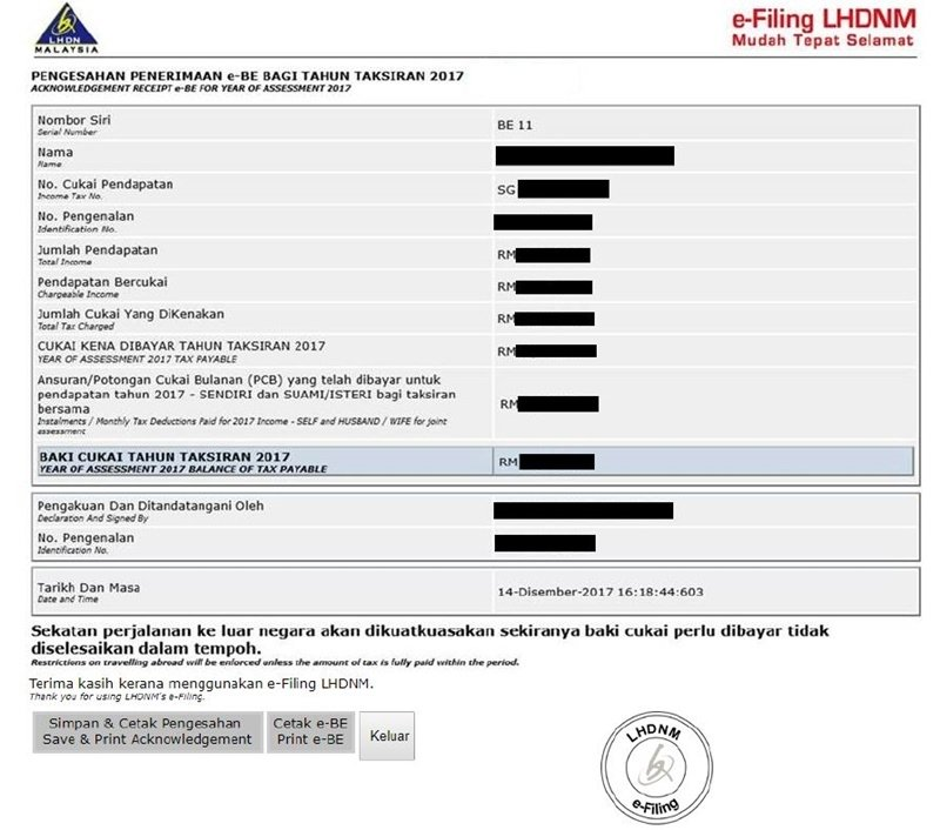

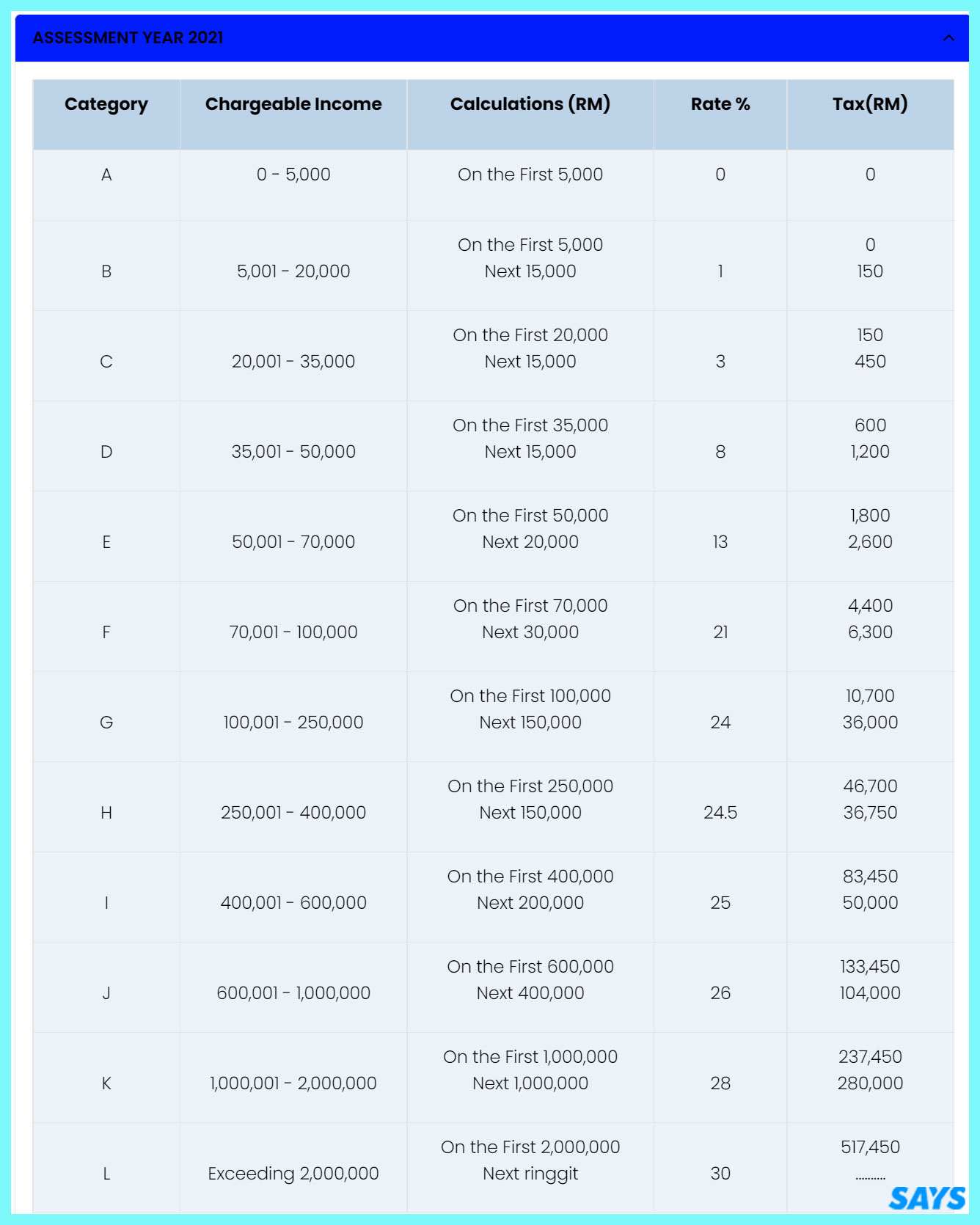

An increasing proportion of income must be paid in tax as the income increases. Form BE Income tax return for individual who only received employment income Deadline. Calculations RM Rate TaxRM A.

Provide your income details. You can then declare any donations or gifts that you have received. Dividends that were not subject to tax at the corporate level will be taxed at a 35 flat rate and the net income resulting from subtracting such tax from the gross income will be subject to an additional tax according to the previous table.

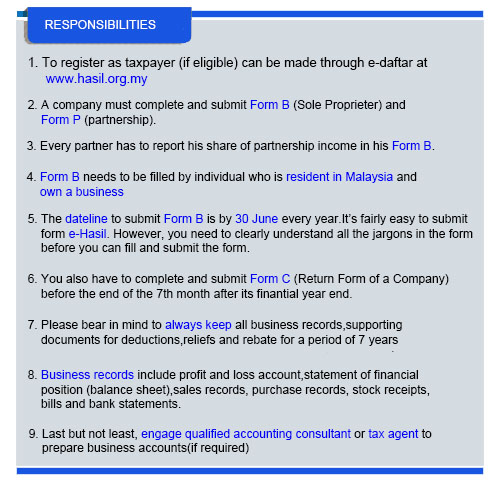

Form used by company to declare employees status and their salary details to LHDN Deadline. 30042022 15052022 for e-filing 5. The annual exclusion applies to gifts to each donee.

Hearst Television participates in various affiliate marketing programs which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. The outdated inheritance tax rules costing families 137330. One must file an income tax return to justify hisher income.

Further you can also file TDS returns generate Form-16 use our Tax. The statement provides additional details about the financials of the company based on which the tax authority decides whether or not to initiate a tax audit. May 02 2019 at 238 pm.

Youll need to fill in a separate tax return. Get the latest international news and world events from Asia Europe the Middle East and more. If you are a cash basis taxpayer you report rental income on your return for the year you receive it regardless of when it was earned.

These were the two components of the socialized farm sector that began to emerge in Soviet agriculture after the October Revolution of 1917 as an antithesis both to the feudal structure of impoverished serfdom and aristocratic landlords and. Form B Income tax return for individual with business income income other than. In other words if you give each of your children 11000 in 2002-2005 12000 in 2006-2008 13000 in 2009-2012 and 14000 on or after January 1 2013 the annual exclusion applies to each gift.

On the First 5000 Next 15000. In this regard to avail tax advantages to its fullest it is crucial to understand the existing income tax slab for the fiscal year. How to Declare Income.

Hearst Television participates in various affiliate marketing programs which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. Was a form of collective farm in the Soviet UnionKolkhozes existed along with state farms or sovkhoz. On the First 5000.

As a cash basis taxpayer you generally deduct your rental expenses in the. Income Tax SlabBrackets Applicable for FY 2019-20. Income tax is a tax imposed by the government on the income earned by individuals and businesses.

Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. The base of energy suppliers income tax is similar. Do i declare in Malaysia in which may required to pay tax in malaysia.

If you do not usually send a tax return you can register for Self Assessment to declare any income you have not paid tax on from the last 4 years. You can also declare any tax incentives you have received at this step. Income Tax in India has been filed annually based on Previous Year and Assessment year Previous Year.

Individuals who own a property in Malaysia that isnt used for business purposes and receive a rental income are subject to income tax. Latest news from around the globe including the nuclear arms race migration North Korea Brexit and more. How to Declare Income.

In the above case a company may decide to pay CIT based on the minimum tax base or may declare a statement in the CIT return. How second home owners could save 240k in tax. PROFITS TAX -- Tax imposed on business profits in addition to ordinary income tax or as distinct from income tax imposed on other forms of income.

Find out how much Thailand income tax youll pay when working or retiring here and the deductions and allowances you can claim back. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. See todays top stories.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website. According to income tax rules Previous Year also known as the Financial Year begins on 1st April of the current year and ends on 31st March of the next year. The main intention of the introduction of this tax is to encourage companies to declare a dividend to the shareholders.

Our experienced journalists want to glorify God in what we do. 31032022 30042022 for e-filing 4. PROGRESSION -- The rates of individual income tax are usually progressive ie.

Cut to income tax in doubt under new Chancellor. All rental income must be reported on your tax return and in general the associated expenses can be deducted from your rental income. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing.

You can efile income tax return on your income from salary house property capital gains business profession and income from other sources.

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

/do0bihdskp9dy.cloudfront.net/02-05-2022/t_ea5f75078d2e49d38697211d45b551b8_name_file_1280x720_2000_v3_1_.jpg)

Kansas Plan To Lure Big Project Snags On Corporate Tax Cuts

Malaysia Personal Income Tax Guide 2020 Ya 2019

M Sians Who Don T Declare Income Tax By July 2019 Will Face Penalty Up To 300 R Malaysia

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Malaysians Must Know The Truth File The Right Form And Be Aware Of Exemptions Taxpayers Told

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

How To File Income Tax In Malaysia 2022 Lhdn Youtube

9 Income Tax Ideas Income Tax Income Tax

Partnership Business In Malaysia 3 Steps To Declare Income Tax If You Re Non Profitable

Oveetha Management Services Income Tax Submission Is Due Very Soon If You Need To Do E Filing For Business Enterprise Income Tax Form B It Can Approach Me For Below

How To File Income Tax For The First Time

Everything You Need To Know About How To File Taxes For An Llc In The U S Freshbooks Blog

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Cukai Pendapatan How To File Income Tax In Malaysia

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Journal Entry For Income Tax Refund How To Record In Your Books

How To File Income Tax For The First Time

0 Response to "how to declare income tax malaysia"

Post a Comment